For businesses all around the globe, controlling company spending is an essential component of financial management. Although the conventional approach to recording costs is via receipts, there are circumstances in which receipts can be misplaced or unavailable. This article examines practical methods for keeping track of costs without receipts while adhering to various international accounting standards. But how to record expenses without receipts? Some ideas are here.

Making Use of Digital Statements and Transactions

Many transactions in the modern digital era create an electronic trail, which is quite helpful for monitoring expenses. Credit card records and bank statements are well recognized types of documentation. These documents provide a transparent audit trail by listing every transaction’s date, amount, and vendor in detail. Businesses operating internationally should make sure that their banking institutions provide complete and user-friendly transaction histories.

Making Use of Supplementary Documentation

If receipts are not accessible, company costs may still be supported by other forms of proof. Proof may include cancelled checks, invoices, email confirmations of transactions, and even pictures of the goods you’ve bought. For example, the email receipt for a commercial transaction made online may be stored and kept.

Putting in Place Regular Record-Keeping Procedures

For enterprises throughout the world, maintaining consistent records is essential. The possibility of losing receipts may be reduced by establishing a process for recording costs. This entails keeping a daily journal of your spending, classifying them correctly, and updating your financial records on a regular basis.

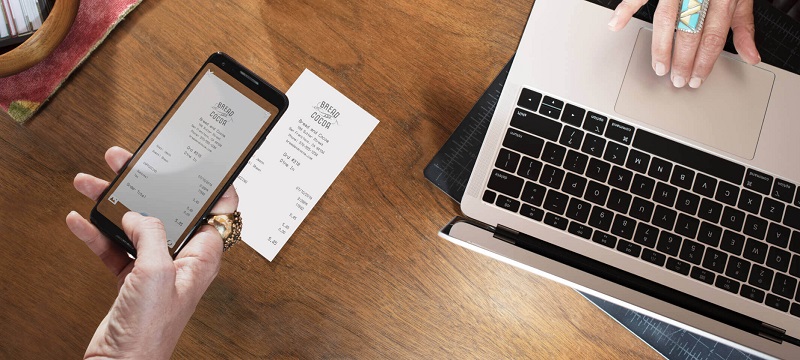

Using Digital Tools for Expense Management

The effectiveness of tracking costs without receipts may be greatly improved using digital tools and programs for expense management. These technologies often have automated data input, receipt scanning, and accounting system connection. Choosing solutions that handle different languages and currencies is crucial for firms operating internationally.

Getting Expert Financial Guidance

Considering the intricacies of global financial legislation, consulting an expert might be advantageous. Global standard-aware accountants and financial consultants may advise companies on proper documentation procedures and assist them in setting up strong internal controls. They may also guarantee that the company’s expense-recording procedures comply with local legislation and provide insights into certain area needs. Businesses may manage the challenges of international accounting and keep accurate and trustworthy financial records by using professional knowledge.

Conclusion

In conclusion, there are a number of options that may successfully accomplish the same goal as using receipts, even if this is the conventional way of recording company spending. Businesses globally may make sure that their costs are correctly documented and in compliance with international standards by employing digital transactions, adopting digital technologies, adopting alternative documents, establishing consistent record-keeping methods, and consulting experts. Regardless of region, these tactics not only help with improved financial management but also get companies ready for financial reporting and audits.